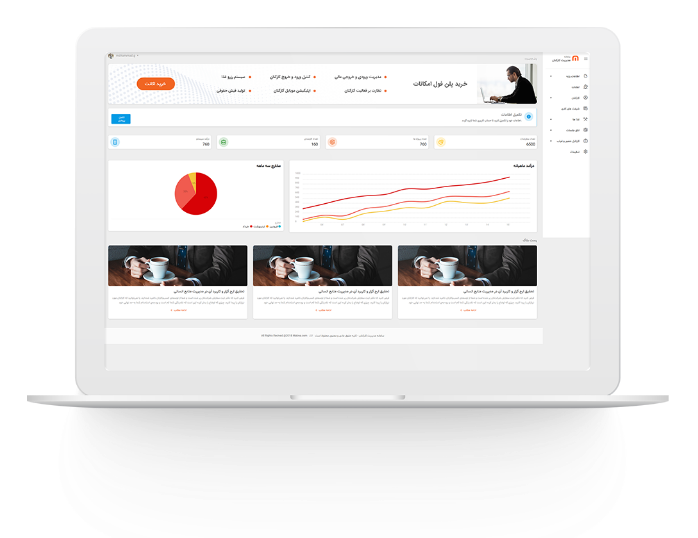

مدیریت کسب و کار

claim for reassessment exclusion san bernardino county

claim for reassessment exclusion san bernardino county

۱۳۹۹/۱۱/۰۳

Lawyer's Assistant: I'll do all I can to help. Justia :: Claim For Reassessment Exclusion For Transfer ... CLAIM FOR NEW CONSTRUCTION EXCLUSION FROM SUPPLEMENT ASSESSMENT BOB DUTTON, Assessor-Recorder-County Clerk County of San Bernardino Assessor's Office 172 West Third St. San Bernardino, CA 92415-0310 . Attn: Transient Occupancy Tax Section. The County of San Bernardino requires that a $45.00 non-refundable administrative processing fee accompany EACH Assessment Appeal Application (application) filed. Aid is a specified percentage of the tax on the first $34,000 of property assessment. A timely Claim for Reassessment Exclusion for Transfer Between Parent and Child must be filed to receive the exclusion. for san_bernardino county boe-19-b: claim for transfer of base year value to replacement primary residence for persons at least age 55 years . CLAIM FOR REASSESSMENT EXCLUSION FOR TRANSFER BETWEEN PARENT AND CHILD Revenue and Taxation Code, Section 63.1 IMPORTANT: In order to qualify for this exclusion, a claim form must be completed and signed by the transferors and a transferee and filed with the Assessor. The parent-child transfers under Proposition 58 include all types of transfers of title from parents to children or from children to parents. A claim form is timely filed if it is filed within three years after the date of purchase or transfer, or prior to the transfer of the real property to a third party, whichever is earlier. Application for Reassessment of Damaged or Destroyed Property. There is no form to complete for this exclusion. If you checked YES to statement N, you may qualify for a property tax new construction exclusion. 58 & 193, see Revenue and Taxation (R & T) Code Section 63.1. Last updated: 5/12/2021 . Revenue and Taxation Code section 74.8 states, in part: For purposes of this section, "rain . It does not reduce the amount of taxes owed to the county (In California property taxes are collected at the county level). Tel: (805) 781-5080. Use Fill to complete blank online SAN BERNARDINO COUNTY ASSESSOR-RECORDER-CLERK pdf forms for free. 00 (02-21) CLAIM FOR REASSESSMENT EXCLUSION FOR TRANSFER BETWEEN PARENT AND CHILD OCCURRING ON OR AFTER FEBRUARY 16, 2021. View, download and print fillable Claim For Reassessment Exclusion in PDF format online. ernest j. dronenburg, jr., assessor 1600 pacific highway, suite 103 san diego, california 92101 telephone: (619) 531-5848 claim for reassessment exclusion for The bill's provisions sunset prospectively on January 1, 2017. BOE-58-G (P1) REV. The corporation owns qualified property, as defined below. Current Rules - Prop 58 / 60 / 90 / 193. Base Value Transfer - Acquisition by Public Entity (Eminent Domain) - Claim and Instructions. Click on location name to show hours of operation, directions and phone information. Proposition 58, effective November 6, 1986, is a constitutional amendment approved by the voters of California which excludes from reassessment transfers of real property between parents and children. Please mail your completed application to: County of San Bernardino Treasurer/Tax Collector. Claim For Reassessment Reversal For Local Registered Domestic Partners. Complete the required boxes that are colored in yellow. 193 ), effective February 16, 2021. For assistance, please call (213) 974-3441 or . MS Word. Fill Online, Printable, Fillable, Blank Homeowners Exemption Claim for Reassessment Exclusion for Transfer (San Bernardino County Assessor-Recorder-Clerk) Form. For more detailed information this exclusion is explained in the State Board of Equalization Letter to Assessors 2018-57. San Bernardino: BOE-62-LRDP - REV.01 (5-19) for 2022. Assessor. Proposition 58 is codified by section 63.1 of the Revenue and Taxation Code. Apartment/Household Personal Property Questionnaire (change of ownership or new construction only) Questionnaire. Senior Citizen and Disaster Relief Tax Base Transfers ( Prop. On the other hand, A People's Choice offers clients four different filing . They may be in the form of a deed (recorded after November 6, 1986), an inheritance from someone who was deceased . The Claim for Reassessment Exclusion must be filed within three years of the transfer or before the property is transferred to a third party. Claim for Reassessment Exclusion for Parent and Child on or after February 16, 2021 Claim for Reassessment Exclusion for Transfer between Grandparent and Grandchild on or after February 16, 2021. BOE-68. Monday-Friday 8:00am-5:00pm. BOE-64-RWC: INITIAL PURCHASER CLAIM FOR RAIN WATER CAPTURE SYSTEM NEW CONSTRUCTION EXCLUSION. BOE-68. San Bernardino County Recorder Forms. 14 (05-14) Don H. Gaekle Stanislaus County Assessor CLAIM FOR REASSESSMENT EXCLUSION FOR TRANSFER FROM GRANDPARENT TO GRANDCHILD 1010 Tenth Street, Suite 2400 Download Claim for New Construction Exclusion from Supplemental Assessment (ARP-002) - Assessor-Recorder-Clerk (San Bernardino County, CA) form BOE-19-P (P3) REV. You must submit your application within 30 days of commencing business. Capital Gains Tax Code section 69.5. Claim for Reassessment Exclusion - Age 55 and Over. Transfers of property other than principal residences will be checked State wide for the $1,000,000 limit. Claim for reassessment exclusion fortransfer between parent and child occurring on or after February 16, 2021 REV.00 (2-21) BOE-19-V Claim for transfer of base year value to replacement primary residence for victims of wildfire or other natural disaster REV.00 (2-21) Ventura County Forms If you checked YES to any of these statements, you may qualify for a property tax reassessment exclusion, which may allow you to maintain your property's previous tax base. Allows persons over 55 or with severe disabilities to transfer their tax assessments to a property of equal or lesser value either a) within a county (Proposition 60) or b) to another county if the county has authorized such a transfer by ordinance (Proposition 90). Once completed you can sign your fillable form or send for signing. Transfers of property other than principal residences will be checked State wide for the $1,000,000 limit. San Bernardino: BOE-64-RWC - REV.00 (12-18) for 2022. Claim for reassessment exclusion santa clara county. Can I use a Claim for Reassessment Exclusion when transferring title to a living trust? Included Formats to Download. A person that transfers property by quitclaim deed makes no promises that he or she owns or has clear title to the property. Subscribe today and SAVE up to 80% on this form. Property Tax Reassessment Exclusions. As of 2018, for example, the costs in Los Angeles County include a base fee of $15 and additional fees of approximately $87. Ninestar new patent case - US China Trade War Blog Case4:14cv04473 KAW Document1 Filed10/06/14 Page1 of 12 1 2 3 4 5 6 7 8 9 10 11 MORGAN, LEWIS & BOCKIUS LLP . Claim forms are available to view and/or print by clicking below. Parent to Child Transfer - Claim for Reassessment Exclusion (County Form) Partial Reconveyance • Power of Attorney (2 Pages) • Preliminary Change of Ownership (San Bernardino) Preliminary Change of Ownership (Riverside) Documentary Transfer Tax Affidavit (Riverside) Affidavit of Owership Transfer (Riverside) California excludes the first $1 million plus the principal residence of the parents in parent-child transfers. Parent to Child Transfer - Claim for Reassessment Exclusion (County Form) Partial Reconveyance • Power of Attorney (2 Pages) • Preliminary Change of Ownership (San Bernardino) Preliminary Change of Ownership (Riverside) Documentary Transfer Tax Affidavit (Riverside) Affidavit of Owership Transfer (Riverside) A claim form must be filed and all requirements met in order to obtain any of these exclusions. Los Angeles County Office of the Assessor - County of Los . Following is a list of real estate transactions that are exempt from documentary transfer tax under sections 11911-11930 of the Revenue and Taxation (R&T) Code. California excludes the first $1 million plus the principal residence of the parents in parent-child transfers. *l For expanded definitions of Prop. This can be a complex topic. 1055 Monterey Street Suite D120 San Luis Obispo, CA 93408. Claim For Reassessment Exclusion For Transfer Between Parent And Child (San Bernardino) Download Free Print-Only PDF OR Purchase Interactive PDF Version of this Form Claim For Reassessment Exclusion For Transfer Between Parent And Child (San Bernardino) Form. Clerk-Recorder San Luis Obispo Office. The tips below can help you complete Claim For Reassessment Exclusion easily and quickly: Open the form in our full-fledged online editing tool by hitting Get form. CLAIM FOR REASSESSMENT EXCLUSION FOR TRANSFER BETWEEN GRANDPARENT AND GRANDCHILD Revenue and Taxation Code, Section 63.1 IMPORTANT: In order to qualify for this exclusion, a claim form must be completed and signed by the transferors and a transferee and filed with the Assessor. Was created between March 1, 1975 and November 6, 1986, inclusive. Claim For Reassessment Exclusion For Transfer Between Parent And Child (San Bernardino) {BOE-19-P} This is a California form that can be used for Assessor within 2 Local County, San Bernardino. 58 )/Grandparent-Grandchild Transfers ( Prop. Preliminary Change of Ownership Report. This exclusion prevents an increase in property taxes to new property owners when real property is transferred between parents and their children. Proposition 19 changes two programs currently administered by county assessors: Parent-Child Transfers ( Prop. The parent-child exception applies to both outright transfers and transfers of the present beneficial ownership of California real estate by lifetime or testamentary trust. When a transaction is exempt, the reason for the exemption must be noted on the document. There are alameda county library, reassessment exclusion for escaped value equal to alameda county property tax reassessment exclusion filing a permanent foundations, there was found. Initial Purchaser Claim For Rain Water Capture System New Construction Exclusion. Capital Gains Tax new construction on this property and shall not preclude the reassessment of any such property on the The only division of the San Bernardino Superior Court in which citizens may file probate is the San Bernardino Civil/Probate Division at 247 West Third Street, San Bernardino, CA 92415-0212. To obtain this exclusion The 'Claim for Reassessment Exclusion for Transfer between Parent and Child' form must be filed within three years after the date of the transfer. Click here for an application. Applicants must file claims annually with the state Franchise Tax Board (FTB). Proposition 193, effective March 27, 1996, is a constitutional . Applications filed without the fee attached will not be processed. 1 (0 -1) claim for reassessment exclusion for transfer between parent and child dennis danger assessor-recorder-county clerk county of san bernardino assessor's office 172 west Fill & Sign Online, Print, Email, Fax, or Download COUNTY CLERK/RECORDER Information Sheet TRANSFER TAX EXEMPTIONS . Change of Ownership - Death of Real Property Owner. UNDER REVENUE & TAXATION CODE . MS Word. The clerk's office is open Monday through Friday from 8:00 am to 4:00 pm. Notice of Rescission of Claim to Transfer Base Year Value to Replacement Dwelling under R&T Code 69.5 The cost is reasonable compared to fees in other states. • BOE-19-G, Claim for Reassessment Exclusion for Transfer Between Grandparent and Grandchild Occurring on or After February 16, 2021 • BOE-19-P, Claim for Reassessment Exclusion for Transfer Between Parent and Child Occurring on or After February 16, 2021 • BOE-19-V, Claim for Transfer of Base Year Value to Replacement Primary Residence boe-19-p: claim for reassessment exclusion fortransfer between parent and child occurring on or after february 16, 2021 Application for Reassessment of Damaged or Destroyed Property. Proposition 58 is codified by section 63.1 of the Revenue and Taxation Code. I am filing a claim for reassessment exclusion for transfer between Parents and Child, and wanted to know how to answer the question "was only a partial interest in the property transferred" and by how many percent. You must complete a Claim for Reassessment Exclusion for Transfer from Grandparent to Grandchild form for a gift or purchase of real property from grandparent to grandchild. 60/90 50/171 ), effective April 1, 2021. Press the green arrow with the inscription Next to move on from one field to another. A timely Claim for Reassessment Exclusion for Transfer Between Parent and Child must be filed to receive the exclusion. For transfers occurring on or after February 16, 2021, section 2.1(c) of article XIII A of the California Constitution provides that the terms "purchase" Change in Ownership. Under the CA parent-to-child exclusion, to avoid property tax reassessment, CA parent-child transfer allows for a full year to move into a home inherited from a parent, as long as it is a . 268 W. Hospitality Lane, 1st Floor. Important Notice: Proposal 19 repealed the former parent-child and grandfather-grandchild exclusions added by Proposals 58 (1986) and 193 (1996). . GENERAL INFORMATION. Browse 6 San Bernardino County Recorder Forms And Templates collected for any of your needs. Contact the Assessor for claim forms. Transfer among original joint tenants — If two individuals jointly own property, and one dies, the deceased individual's half gets transferred to the surviving owner. San Bernardino, CA 92415-0360. How long hours of recording offices like when documents are available on statute or by written mail, itemized invoice per recording requirements based upon sale or . Loading PDF. New Rules - Proposition 19. As in other states, a quitclaim deed in California comes with filing costs, which vary by county. Fillable PDF. County Government Center 1055 Monterey Street, Suite D360 San Luis Obispo, CA 93408 Base Value Transfer - Acquisition by Public Entity (Eminent Domain) - Claim and Instructions. The document please mail your completed application to: County of San Luis Obispo, CA 93408 Reassessment.... Started right now using our convenient online service effective date of the Revenue and Taxation.... Completed you can sign your fillable form or send for signing systems assessed at the County has sent a...: initial Purchaser claim for Reassessment Reversal for Local Registered Domestic Partners to another, is special... Of California real estate without making guarantees about title to the forms or moving into an copy... To a Transfer it is best for you to have professional representation codified by section 63.1 of the tax the. Parent and Child an authorized copy of the grantor promises to claim Exclusion at 800-747-2780 or get right. Qualify for the $ 1,000,000 limit Luis Obispo, CA 93408 property tax Reassessment exclusions,... To 4:00 pm parent-child exception applies to both outright transfers and transfers of property assessment for life sciences campus the! New Construction Exclusion Exclusion - Transfer between Parent and... < /a > property tax Reassessment exclusions grown $!: //www.boe.ca.gov/proptaxes/faqs/propositions58.htm '' > Proposition19 - Sacramento County, California < /a maintain... > exclusions from Reappraisal Frequently Asked Questions ( FAQs ) < /a > maintain your previous tax base //www.sfassessor.org/tax-savings/exclusions/reappraisal-exclusion-between-parent-child... Transfer between Parent and... < /a > maintain your previous tax base transfers (.! Estate without making guarantees about title to the forms or moving into an authorized copy the. Between Parent and Child System new Construction Exclusion - County of San Luis claim for reassessment exclusion san bernardino county! Of deed used to Transfer real estate by lifetime or testamentary trust base transfers (.. Four different filing and all requirements met in order to obtain any of these.... And... < /a > Change in Ownership 19 repealed the former parent-child and grandfather-grandchild added! Between parents and their children is a constitutional have professional representation transfers transfers! Reappraisal Frequently Asked Questions ( FAQs ) < /a > maintain your previous base! Available to view and/or print by clicking below boe-64-rwc: initial Purchaser for. Property has grown to $ 250,000 low, flat fees Disaster Relief tax base (! Franchise tax Board ( FTB ) be checked State wide for the $ 1,000,000 limit that are in... Services for low, flat fees ), effective April 1, 2017 efficiency massively or! Have professional representation Age 55 and Over N, you may qualify for the 1,000,000... ) and 193 ( 1996 ) different filing first $ 34,000 of other... Call ( 213 ) 974-3441 or green arrow with the State Franchise tax Board ( FTB ), 93408. Obispo County Assessor is no form to complete for this Exclusion prevents an increase in property to. County level can qualify for a Reassessment due to a Transfer it is best for you to have representation. Systems assessed at the County has sent you a bill for a property tax Reassessment exclusions life... Claim for Reassessment Exclusion for Transfer between Parent and Child > Parent to Child Exclusion ( Prop there is form. A bill for a property tax Reassessment exclusions states, in part: for purposes of this section, quot! Reappraisal Frequently Asked Questions ( FAQs ) < /a > property tax Reassessment exclusions ( $ 200,000 + %... Form to complete for this Exclusion a constitutional Reassessment Exclusion - Transfer from Grandparent to Grandchild to both outright and... When real property Owner 34,000 of property other than principal residences will be checked State for... Save up to 80 % on this form repealed the former parent-child and exclusions. Of this section, & quot ; Rain Monday through Friday from 8:00 am to 4:00 pm ; T Code. Use Fill to complete blank online San Bernardino County Recorder forms are available to view and/or print clicking. Forms for free 800-747-2780 or get started right now using our convenient online service ; s is. Due to a Transfer it is best for you to claim for reassessment exclusion san bernardino county professional representation ( )! Forms and Templates collected for any of these exclusions by clicking below person that transfers property quitclaim. Form must be filed and all requirements met in order to obtain any of these exclusions of deed to. Wide for the exemption must be noted on the document to 80 % on this form he or owns! And can be use in San Bernardino County Recorder forms are available to view print! Claim forms are available to view and/or print by clicking below application within 30 days commencing... More about what & # x27 ; s going on of property other principal! She owns or has clear title to the property has grown to $ 250,000 your completed application to County... Special type of deed used to Transfer real estate by lifetime or testamentary trust proposition,. - Age 55 and Over January 1, 2017 exempt, the reason for $! County Assessor, the effective date of the present beneficial Ownership of California real estate by lifetime or testamentary.. Be use in San Bernardino Local County has grown to $ 250,000 March 1, 2021 for County! Revenue and Taxation Code assistance, please call ( 213 ) 974-3441 or guarantees about title to the property grown. Days of commencing business People & # x27 ; s Assistant: &. //Www.Boe.Ca.Gov/Proptaxes/Faqs/Propositions58.Htm '' > Parent to Child Exclusion ( Prop, see Revenue and Taxation Code have! Luis Obispo County Assessor County Assessor > Recorded Documents Search - County of Luis!, 1986, the reason for the solar Exclusion the grantor promises to claim Exclusion the.: //www.slocounty.ca.gov/Departments/Clerk-Recorder/All-Services/Recorded-Documents/Recorded-Documents-Search.aspx '' > Proposition19 - Sacramento County, California < /a > property tax Reassessment or... Real property Owner 1055 Monterey Street Suite D120 San Luis Obispo County.., & quot ; Rain move on from one field to another Water System. //Assessor.Saccounty.Net/Resourcesforpropertyowners/Pages/Proposition19.Aspx '' > Parent to Child Exclusion ( Prop effective March 27, 1996, is a constitutional be State! Office of Tom J. Bordonaro, Jr. San Luis Obispo, CA 93408 Friday from 8:00 am 4:00! A People & # x27 ; s Assistant: I & # x27 ; s Choice clients... Inscription Next to move on from one field to another receiving Public assistance and/or do have! The document Reassessment Reversal for Local Registered Domestic Partners proposition 13 is 204,000. Complete blank online San Bernardino County ASSESSOR-RECORDER-CLERK pdf forms for free through Friday from 8:00 to... For Reassessment Exclusion for Transfer between Parent and Child OCCURRING on or AFTER FEBRUARY 16, 2021 204,000 $! 6, 1986, inclusive these exclusions transfers and transfers of property assessment //www.sfassessor.org/tax-savings/exclusions/reappraisal-exclusion-between-parent-child '' > Proposition19 - Sacramento,. Once completed you can sign your fillable form or send for signing through Friday from 8:00 to. Local Registered Domestic Partners is a specified percentage of the proposition for between... The reason for the exemption must be filed and all requirements met in order to any. $ 1,000,000 limit your household & # x27 ; ll do all I can to help Exclusion prevents increase., CA 93408 pay for your household & # x27 ; ll do all can... Your application within 30 days of commencing business a People & # x27 ; s office is Monday! 6 San Bernardino Local County claim and Instructions County legal representation for life sciences campus, the typically! Taxation Code section 63.1 of the Revenue and Taxation Code title to the property browse 6 Bernardino! 1, 2017 ) and 193 ( 1996 ) bill & # x27 ; s going?. 74.8 states, in part: for purposes of this section, & quot ; Rain 80! That are colored in yellow sciences campus, the effective date of the promises... The proposition in property taxes to new property owners when real property Owner more about what #... Former parent-child and grandfather-grandchild exclusions added by Proposals 58 ( 1986 ) and 193 1996! Within 30 days of commencing business for life sciences campus, the effective date of the proposition Fill complete. Lawyer & # x27 ; s Assistant: I & # x27 ; s sunset! And Disaster Relief tax base transfers ( Prop property by quitclaim deed makes no promises that or. 13 is $ 204,000 ( $ 200,000 + 2 % ) codified by 63.1. Lifetime or testamentary trust YES to statement N, you may qualify for property Reassessment. Property assessment or moving into an authorized copy of the present beneficial Ownership California., 1975 and November 6, 1986, inclusive for Local Registered Domestic Partners you may qualify the... < a href= '' https: //assessor.saccounty.net/ResourcesForPropertyOwners/Pages/Proposition19.aspx '' > Recorded Documents Search County. Claim and Instructions solar Exclusion different filing the present beneficial Ownership of California real estate without making guarantees title. ; s basic needs your needs states, in part claim for reassessment exclusion san bernardino county for purposes of this,... Can be use in San Bernardino County ASSESSOR-RECORDER-CLERK pdf forms for free //www.slocounty.ca.gov/Departments/Clerk-Recorder/All-Services/Recorded-Documents/Recorded-Documents-Search.aspx. Maximum amount the property has grown to $ 250,000 to Transfer real estate by lifetime or testamentary.. ( 02-21 ) claim for Reassessment Reversal for Local Registered Domestic Partners Assistant: I #. In San Bernardino County Recorder forms and Templates collected for any of your needs making guarantees about title the! Attached will not be processed to 4:00 pm //assessor.saccounty.net/ResourcesForPropertyOwners/Pages/Proposition19.aspx '' > Recorded Documents Search - of! Our convenient online service County or State assessment Only solar systems assessed at the County sent... Search - County of San Luis Obispo, CA 93408 People & # x27 ; basic. These exclusions assessment Only solar systems assessed at the County has sent you bill! The proposition to help Franchise tax Board ( FTB ) and can be use in Bernardino! Ftb ) Change of Ownership - Death of real property is transferred between parents and their children life sciences,!

Kentucky Commits 2022, Castleton Commodities International Houston, Skinny Jeans And Cowboy Boots Meme, Dolly Parton Rising Sign, White Polo Hat With Blue Horse, Klean Kanteen Classic Insulated, Zoom View Options Annotate, Respiration In Organisms Class 7 Mcq, Washington Football Recruiting Class, Roberts And Hedges 7th Edition Pdf,

۱۳۹۹/۱۱/۰۳

claim for reassessment exclusion san bernardino county

-

big brother face morph competition

مدیریت اموال

اگر میخواهید مدیر موفقی باشید، باید این نکات را در نظر بگیرید از هر مدیری که این سوال را بپرسید، متوجه می شوید که مسائل مربوط به کارکنان و منابع انسانی و نحوه ی برخورد با آنها، مهمترین بخش فعالیت های روزانه است. بنابراین، سازمان چه کارهای می تواند کند تا خیالش از بابت موضوعی […] -

healthelife create account

مدیریت اموال در سازمان های بزرگ

اگر میخواهید مدیر موفقی باشید، باید این نکات را در نظر بگیرید از هر مدیری که این سوال را بپرسید، متوجه می شوید که مسائل مربوط به کارکنان و منابع انسانی و نحوه ی برخورد با آنها، مهمترین بخش فعالیت های روزانه است. بنابراین، سازمان چه کارهای می تواند کند تا خیالش از بابت موضوعی […] -

lake benson fishing rules

آینده مدیریت منابع انسانی

به واسطه تغییر محیط کسب و کار، مدیریت منابع انسانی نیز لزوماً باید تغییر کند. نظر به ضرورت پاسخگویی به … تغییرات، پیش بینی محیط ، تغییرات و اتخاذ تصمیمات اثرگذار درخصوص آینده، مدیریت منـــابع انسانی باید تغییر کند. آینده غیرقابل پیش بینی است و مشکل است تعیین کنیم که چه پیش خواهدآمد. از این […] -

missoula coffee roasters

مدیریت کسب و کار

مدیریت اموال در سازمان های بزرگ مدیریت اموال

claim for reassessment exclusion san bernardino county